Welcome Back

Sign up for IRG account Login with your existing IRG account

Are you a Real Estate Professional? Register here.

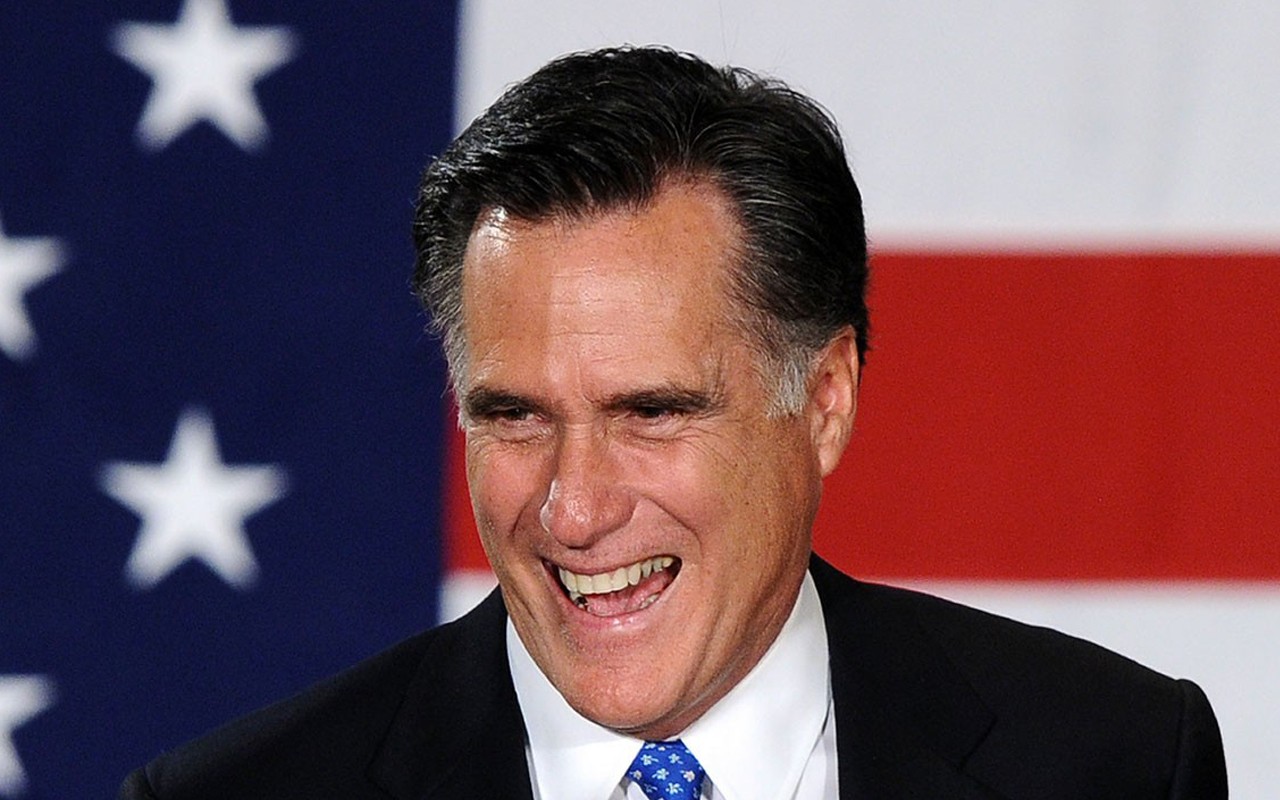

Following closely behind our news release of September 19th where UK Prime Minister David Cameron stated in the House of Commons that British Overseas Territories should not be labeled tax havens negatively, we at IRG Ltd. in Cayman are thrilled that other big names in the US political scene appear to be of the same opinion. Jeremy Hurst, Associate Broker at IRG Ltd. head office in Grand Cayman says; “This applies specifically to the Cayman Islands which always seem to bear the brunt of bad press when it comes to tax avoidance by US citizens and corporations." So ask yourself what all the following Americans have in common: Bill Clinton: 42nd President of the United States 2004 Democratic presidential candidate, former Senator, current U.S. Secretary of State U.S. Secretary of the Treasury 2012 Republican presidential candidate, former governor of Massachusetts President Obama’s U.S. Trade Representative Yes, several are, or were, political figures serving at various levels in the U.S government. Three ran for president and one was elected to office. But they also have something else in common, lesser known, but still very important to you. What they have all done—along with thousands of other intelligent American investors and companies—is make safe investments and use income-producing legal structures based in the Cayman Islands. All these Americans presumably pay applicable taxes on the investments they report to the IRS, but they deliberately set up these investments in the Cayman Islands because the combination of laws here, as well as U.S. tax breaks, can, and do, help to legally reduce their U.S. tax burdens. If they can do it, why can’t you? Forget the irresponsible and undeserved media-manufactured reputation. The Cayman Islands is an offshore financial center that makes a fetish of clean money and it’s run with great care—after all, money and profit are the Islands’ major commodities, and anything that harms its reputation harms both. The Cayman Islands Monetary Authority (CIMA) regulates and supervises all aspects of the financial services industry. It administers special, modern, constantly updated statutes and rules that govern banks, trusts, corporations, insurance, investment funds, securities, money transfer companies, and cooperative and building societies. The Cayman Island are indeed a tax haven, with no apologies for that blissful state of tax freedom so unusual for Americans, the British, French and so many other suffering taxpayers. There are no personal taxes on income, capital gains or sales of real estate, nor are there any death duties, nor inheritance or gift taxes. The Cayman Islands levy no taxes on corporate income. An annual fee is levied on all companies and banks based on shared capital. While under the 2001 U.S. PATRIOT Act, privacy is dead in America—that was true well before the current revelations concerning constant National Security Agency (NSA) spying on the emails, credit cards, phone calls and movements of all Americans all the time—in the Cayman Islands, the right to privacy is still strong. That’s because its legal system is based on British common law, the 1995 Banks and Trust Companies Law and the 1995 Confidential Relationships Preservation Law. Banking staff and government officials face civil and criminal sanctions if information is disclosed without authorization. Several laws permit the enforcement of foreign judgments or the disclosure of information in response to a court order, but usually only based on probable cause of criminal activity or drug use or dealing. The Proceeds of Criminal Conduct Law embodies international “know your customer” rules and requires depositors to provide banks with due diligence documentation: a passport and driving license, proof of physical address, an outline of banking activities and other proofs. The Cayman Islands have tax information exchange agreements (TIEAs) in place with the United States and 18 other governments, giving them a clean bill of transparency. And this haven is convenient to get to. It takes a little over an hour to fly from Miami International Airport (MIA) to Owen Roberts International Airport (GCM) in Grand Cayman, there are daily flights to over 10 US gateway cities and is a short hop to the Sister Islands, Cuba nd Jamaica. These sunny islands are a safe and clean place to do business—and even to reduce your taxes. In spite of having been made a political issue in the U.S., the U.K. and elsewhere, the Cayman Islands offer a host of useful legal entities and activities governed by British common law (as well as the U.S.) and by well-crafted and up-to-date laws and rules. They offer much stronger asset protection and privacy than does the PATRIOT Act-ruled U.S. The Cayman Islands do cater to the very wealthy and to international corporations seeking to maximize tax advantages in a well-developed professional no-tax haven, but there are smiling faces waiting to welcome you, too. And it is a great place for a beach vacation — for fun in the sun after you complete your U.S. tax-deductible travel and business. “You might even want to consider a beachfront second home” says Miles of IRG Ltd. Cayman offers the highest standard of living in the entire region, the infrastructure and lifestyle here is unrivalled and complimented by a quality choice of world class dining, shopping and private schools just to mention a few. Miles adds; “Luxury homes are built to the highest standards and many of them are nestled on quiet white sandy beaches. Others offer protected waterfront locations with the option of boat access to world famous North Sound. The multiple listing system in the Cayman Islands offer the curious investor easy access to a wide choice of homes and condos. Global affiliates like Knight Frank and Luxury Portfolio expands the search network even further. Rum Point, Grand Cayman. IRG Ltd. is the Cayman Island's leading integrated real estate brokerage, as dedicated property professionals we offer our clients and customers a comprehensive range of valuable, real estate services in the residential, commercial, sales, leasing, and property asset management advice as well as private and corporate relocation services. As trusted advisors to high net worth investors and a diverse group of corporations, we have a proven track record in the acquisition and disposal of prime residential, commercial and land developments and investments. We can also undertake, development feasibility studies and market analysis and tailor made marketing strategies for our vendors.

John Kerry

Jack Lew

Mitt Romney

Michael Froman