Welcome Back

Sign up for IRG account Login with your existing IRG account

Are you a Real Estate Professional? Register here.

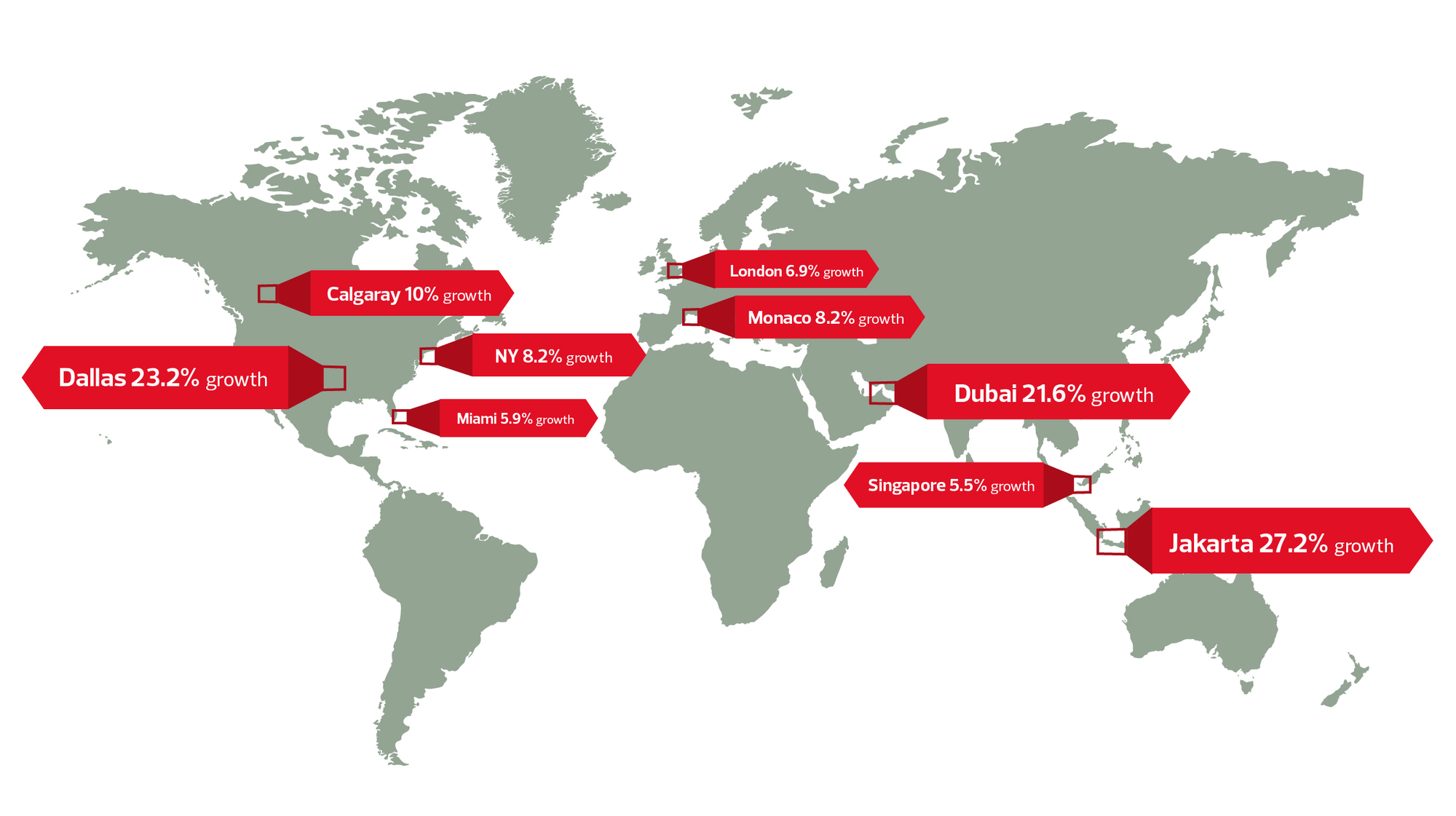

International trends in the market in first half of 2013 are reflected in the Cayman Islands. The luxury housing market has seen a marked upsurge in activity the first half of the year, according to Luxury Portfolio International, a global network of real estate firms. This is in large part due to the healthy return of the U.S. market and strong and steady Canadian luxury real estate market, as well as the return of second home purchases activity. Growth has been notable not only in the number of high-end listings marketed by member firms, but also in the number of companies joining the organization. The increased activity is reflected on Luxury Portfolio International’s website, www.LuxuryPortfolio.com, which currently markets 18,500 properties, 20 percent more listings than this time last year. Traffic to the site is also up. The site is attracting 250,000 visits a month from more than 200 countries, a year-on-year increase of 28 percent. Leads to member brokers are also up almost 40 percent over this time last year. The average price of luxury homes in the world’s key cities increased by 2.4 percent in the second quarter of 2013, a marked improvement on the 0.4 percent fall recorded in the first three months of the year. Knight Frank’s Kate Allen-Everett, head of International Residential Research, confirms that growth of luxury house prices continued to gather pace in the second quarter of 2013. Knight Frank’s Prime Global House Price Index now stands at 27 percent above its low in the second quarter of 2009, during the financial crisis, and has recorded its strongest quarterly growth for three years. Knight Frank affiliate offices report that the top-performing markets, notably Jakarta, Dubai, Shanghai and St. Petersburg, are still recording double-digit annual price growth, but the weakest markets are no longer falling at the rate they were earlier this year. The range between the top and bottom-ranking city has shrunk from 56 percentage points last quarter to 39 points. Not only has the gap narrowed, but also the proportion of cities recording positive price growth has increased, from 52 percent a year ago to 71 percent. European capitals rank at the bottom European capitals such Rome, Paris and Madrid continue to occupy the bottom rankings. Although the rate of price falls has slowed. Across Europe’s prime residential markets, prices fell by 0.9 percent in the year to June, compared to a fall of 3.4 percent in the same period. Policymakers in Asia and Europe are polarized in their approaches. Asia’s governments are stepping up efforts to cool price growth by heightening the restrictions for foreign ownership as highlighted in Knight Frank’s Asia Pacific Residential Review. In contrast, many European economies – particularly the more debt-stricken ones – such as Greece, Spain and Portugal - are taking the opposite tack and introducing “golden visas” and tax incentives to attract non-EU investors to help stimulate their markets. Enthusiasm reappears Luxury Portfolio International sees this growth as reflective of the activity most affiliates are experiencing in their local markets. For example, in southern California, Willis Allen Real Estate reports, “We are seeing a breadth of enthusiasm in our luxury market. In our high-end San Diego communities, activity is quite strong from $2 million to $4 million, as buyers see the possibility that the ‘bottom’ has already passed.” In Dallas, the luxury market is thriving. “Year-to-date luxury home sales in the Dallas-Fort Worth market are up 23.2 percent over the same period last year,” says Mary Frances Burleson, president and CEO of the Ebby Halliday Companies. “It is not at all unusual for a well-priced home to draw multiple offers immediately after going onto the market.” Canadian member CIR Realty also notes significant growth. “The luxury real estate market has been booming in Calgary. The first half of this year has seen 388 MLS sales of homes over $1 million, a 10 percent increase from the same period in 2012. The record for home sales over $1 million in Calgary was in July 2007 at 61 MLS transactions. We have a ways to go to get to peak periods, but if the trend continues at the same pace it has in the past year, we will get there,” says Kirsten Faverin, marketing manager for CIR. As market activity improves, interest in aligning with Luxury Portfolio has surged, with member recruitment on track to potentially double 2012 enrollment. “We have seen an incredible increase in the number of firms seeking affiliation with Luxury Portfolio,” notes Stephanie Pfeffer, executive vice president. “While only a small number of these potential members meet our high standards, including significant luxury market share, experience in the high end and reputation, it has enabled us to expand significantly this year as companies seek the most effective marketing strategies for affluent consumers.” New firms emerging Internationally, there are a number of new firms in emerging territories and in more established luxury markets. New firms include CI Exclusive Properties (Geneva, Switzerland), Ganly Walters (Dublin, Ireland), Sally McGarr Realty Corp. (Niagara-on-the-Lake, Ontario) and Profusion Realty (Westmount, Quebec). In Cayman, IRG’s associate broker Jeremy Hurst concurs with both reports. As the exclusive affiliate for Knight Frank and Luxury Portfolio networks in the Cayman Islands, IRG’s interpretation of the upswing in activity has been mirrored by the firm’s successes this year. Although the local market is a mainstay for IRG, there has been a notable increase in buyers from the U.S. and Canada, most markedly Texas, New York state and Toronto, and those looking to escape the Eurozone. With both of these networks having a strong online presence, there is a new phenomenon of cross-pollination with the U.K.-based high-net-worth investors coming via the U.S. dominant Luxury Portfolio referral network, and now European buyers being channeled through the well- established, London-based Knight Frank chain of offices in 16 key jurisdictions. “Our analytics show a diverse range of inquiries in terms of currency, language and origin, and we have a strong conversion rate from inquiries to sales,” says Miles. With the glimmer of hope of an airport expansion, Miles is optimistic that regarding “regions such as Russia, South America and even Asia, from which we get a tremendous amount of qualified leads, we can make Cayman more accessible. IRG’s global reach ... gives our properties and the Cayman Islands as a first-class investment destination immense exposure to qualified buyers worldwide, and we are committed to marketing Cayman internationally.”